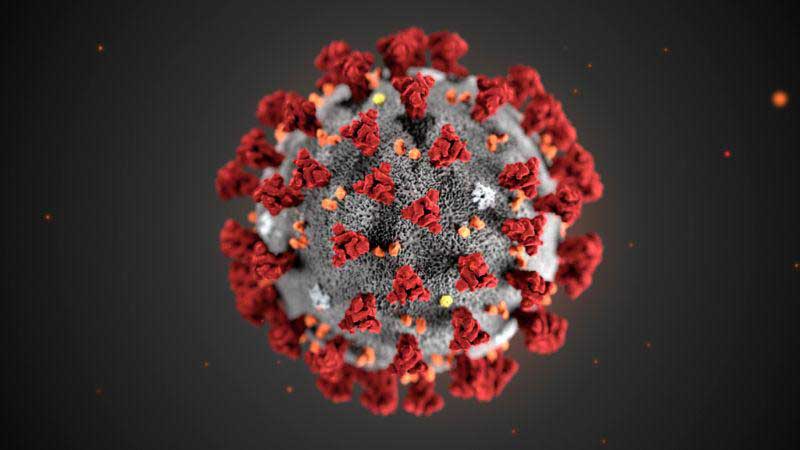

Global airlines are set to lose around $84 billion by the end of this year due to the Coronavirus. The year 2020 will go down as the worst year on record in the history of the aviation industry. The outcome is especially so as the industry braces for the effects of the prolonged lockdown measures globally.

The airlines must find ways to weather this storm despite the prevailing circumstances. With the general apprehension regarding COVID- 19 among potential fliers, the journey back to normalcy may be long-coming.

In the commercial aviation sector, pundits note that it might take more than opening up the global economy for the industry to bounce back. But how much has the pandemic affected commercial aviation?

Financial Impact

By the end of April this year, flights in the United States were down by around 40 percent. On a typical day, an American, United, Delta, Southwest, along with dozens of major carriers are seeing burn rates over 10 Billion a month!

It’s evident that airlines are losing more than money; they are also facing several furloughed pilots and disgruntled passengers. The consequence of this loss has been a 60% reduction in all standard operations. The situation is even more complicated, considering the constant fuel, maintenance, and storage costs the airlines are requiring today.

The financial implications caused by COVD-19 will probably lead to a 90% reduction in revenues over the next year. The trickle-down effect may take more than two years before airlines can finally get back on their feet.

Staff Cuts

About 37,000 Delta employees volunteered to take up unpaid leave from June in solidarity with the airline’s attempt to remain afloat during the current pandemic. The development comes in the wake of a 10 percent staff cut at Boeing Co.

Downscaling is among the most common cost-cutting measures during a financial crisis.

According to a recent report by CNN, for the first time since 1955, employees in the commercial aviation sector are losing jobs in the tens of thousands. The ripple effect of this downsizing will be recognized for many years to come. The long-term impact will be a gap in the service delivery process in a sector that thrives in numbers.

Whether the airlines decide to recall the furloughed staff or conduct fresh recruitment post-COVID-19, the damage will take at least two years to recover. The extent of employee demotivation in the sector may also have a long-term effect on how human resource teams function.

Even in the current limited operational capacity, commercial aviation shareholders need considerable staff to keep the airlines functional much less profitable. However, the need to cut down on employees is an inevitable outcome as revenues dwindle.

Closure of Unprofitable Subsidiaries

Most airlines are dealing with the unfortunate reality of negative cash flow. As such, the smaller airlines will bear the greatest blunt. Closing down unprofitable regionals seems like a plausible solution for many companies.

The sector is likely to witness more closures in the unforeseeable future. This comes in the wake of over $200 billion in loans taken by airlines to avoid bankruptcies, something many have witnessed time and time again over the last four decades.

American Airlines has been among the hardest hit entities by recent capacity reduction measures. In the next two months, more subsidiaries, including compass airlines, will likely cease to operate. The sudden cash crunch will continue to affect the future of affiliates and subsidiaries.

Commercial aviation may face unmet demand over the next three years. Even if people want to fly again, where can they go?

Many will opt out of airlines all together, and some will seek out a private aircraft to travel going forward, our team can help you find the best aircraft values and assist in guiding you to making the right acquisition.

Adjustments to Security Measures

Airlines currently grapple with the implementation of numerous security measures aimed to combat COVID- 19. Now, the aviation industry has had to deal with the onslaught of lousy information, continuously changing TSA guidelines, and confusing regulations for masks.

The onset of the COVID-19 pandemic has necessitated the need to add new layers of screening. The emerging gaps are despite the drastic reductions in the number of personnel. The new social distancing rules will necessitate sophisticated supervisory measures to ensure compliance.

Players in the private aviation sector must also consider additional costs of disinfection. These costs call for extra work-hours and staff.

Further, there are numerous screening points in all exit and entry points. These procedures are bound to affect time and cost optimization during air travel.

The trickle effect on service delivery in the aviation industry is bound to slow down demand. Consequently, more people will avoid this tedious process considering inconveniences caused.

The inconveniences of traveling during the current COVID-19 has led more people to seek private travel options. Are you wondering what small aircraft alternatives are available during this period? You might consider our advice on the best single-engine planes.

Riding out the Storm in Commercial Aviation Will Require a Change in Tact

The commercial aviation sector introduces flexibility, time, and cost optimization. With enhanced corporate security, most executives consider this option as the most reliable. With the onset of COVID-19, global business aviation is literary on its knees.

Surviving past this pandemic might require a change intact. Private travel using smaller planes or helicopters is the best way to deal with the current containment measures.

Are you stuck at how to go about purchasing an aircraft? We have all the appraisals, acquisition, and consultation services you might need.

Are you looking for trusted advice on any matter in the aviation industry? Contact us for unmatched services.