Newsletter 2nd Quarter 2025 (PDF)

Welcome to Q2: A Market Off the Yellow Brick Road

I’m excited to share the beta launched, all-new VREF Online with you. These aren’t minor changes; they are substantial. We didn’t just modernize our look; we revolutionized aircraft valuation delivery.

VREF Online is faster, smarter, mobile-friendly, and more intuitive, and it’s designed for the real-world workflows of appraisers, brokers, buyers, sellers, lenders, and insurers. If you haven’t logged in yet, now’s the time. The new values are live, the data is deeper, and the interface finally works the way it should.

This wasn’t a cosmetic fix. We spent the last two years rewriting our VREF Online valuation platform to give our users the tools they’ve been asking for: faster performance, expanded data sets, and better integration into the daily decision-making process.

The interface is familiar but sharper. The navigation has been streamlined. You’ll spend less time fighting the software and more time doing your job. And yes—it works beautifully on mobile. Our new reports are, in one word, stunning and fully customizable, allowing you to create in depth, easy-to-read reports. In the coming weeks, we will release our API for enterprise clients, and we will consistently add new features throughout the year. You’ll also see better FAA integration and more market data updates as we expand our backend infrastructure.

We built this to solve a problem no one else in the industry has: real time, accurate, intelligent valuation software that isn’t clunky, overpriced, or stuck in 2009. This is VREF reimagined. And it’s live.

We’ve also gone live with the latest aircraft values across all categories, and they’re integrated into the platform. The feedback has been phenomenal. And it doesn’t stop there—our API rollout begins in the coming weeks for enterprise users, giving seamless access to current data and automated workflows. More FAA and transactional data are on the way as we build out deeper analytics and better reporting.

After two years of engineering, the new VREF isn’t just an appraisal tool—it’s your competitive edge in a market that’s moving fast and changing even faster.

Tariffs, Trade Tensions, and a Backdoor Bailout for Boeing?

Let’s talk tariffs. Specifically, what’s happening in aviation and why it feels like there’s a strategy hiding in plain sight?

April’s durable goods numbers nosedived—down 6.3%—and aircraft orders endured the collapse. Non-defense aircraft orders fell over 51%. That’s not a data point. That’s a punch in the aerospace’s face supply chain. Strip out transportation, and the rest of the durable goods category was flat.

What changed? Tariffs. The administration’s “Liberation Day” tariffs hit just before April, and we saw exactly what you’d expect: companies slammed the brakes on new orders, especially where pricing, parts, and long lead times were already fragile.

Now look closer—who benefits when tariffs make imported aircraft and foreign parts more expensive? Who gains when OEMs outside the U.S. suddenly find themselves dealing with higher costs, fewer options, or spooked buyers? You guessed it: Boeing. It’s easy to see the connection.

The federal government can’t write Boeing another $10 billion check—not without political fire, public backlash, and a mess of transparency hearings. But tariffs? Tariffs are the perfect workaround. They make things fairer without giving direct financial help. They raise costs for Airbus, Embraer, Dassault, and Bombardier just enough to nudge operators, buyers, and even leasing companies back toward American-built aircraft—whether they’re the best product on the table.

Meanwhile, Boeing is still struggling. The lingering shadow of the MAX, another delay in the 777X, and shaken confidence in the leadership, continue to plague Boeing. The supply chain is fragile. Certification timelines are a moving target. And let’s be honest: the company is too big to fail. But it’s also too big to bail out again. Tariffs create a pressure release valve—one that quietly directs more business toward Boeing with no one in Washington having to put their name on a check.

It’s not just airframes. Avionics, parts, engines—anything sourced from outside the U.S. is now a question mark. That’s forced buyers to delay, shift strategy, or stick with what they’ve got. MROs are seeing longer wait times for parts. Financing is harder to secure on cross-border deals. And fractional operators are watching margins tighten as costs go up but customer demand plateaus.

For buyers, the landscape just got riskier. For lenders, there’s more uncertainty in valuations. And for everyone? Expect delays. Expect fewer choices. Expect prices to stay sticky for American-made aircraft while foreign-built inventory starts to pile up.

If this is the strategy—create market drag everywhere else to let Boeing regain momentum—it’s risky. But it might work. It might be just enough of a lift to avoid a very public collapse of the nation’s most high-profile exporter. The question now is whether the rest of the industry gets dragged down.

We’re Halfway Through the Year

While Memorial Day usually kicks off a wave of flying activity, this year feels off. Strong new aircraft deliveries exist in a still-fractured market, but pre-owned aircraft are piling up, with OEM trade-ins further pressuring resale channels.

We’ve seen this before, and anyone who lived through 2008 knows what bloated inventories mean. Add in economic uncertainty and an administration slinging tariffs around like they’re party favors, and you’ve got a recipe for paralysis.

We’re seeing real economic reaction to policy shifts. Businesses rushed to import goods before tariffs landed, and now they’re hitting the brakes. It’s the whiplash effect. And it’s bad for aircraft.

Meanwhile, the FAA threw another wrench into the gears with Docket No. FAA–2025–0638, proposing new privacy rules that would allow individual aircraft owners to withhold their personally identifiable information (PII) from the public registry.

I get it—no one likes Robo calls or unsolicited spam. But people thinking that by removing names, addresses, emails, and phone numbers won’t disrupt escrow, financing, title searches, or even basic maintenance coordination is pure fantasy. Escrow agents, lenders, buyers, and service providers rely on that data every single day. Without clear policy guidance and a tiered access system for vetted professionals, this proposal will cause friction, not efficiency. Privacy matters—but killing transparency in the name of convenience will only make transactions slower, riskier, and more expensive.

Market Trends: Overview

OEMs are still acting like they’ve got everything under control, but the numbers tell another story. Deliveries are still behind pre-Covid 2019 numbers.

Gulfstream’s G700s are waiting for delivery slots, lagging being forecasts and creating massive valuation drops in both the 550 and 650 market. Bombardier’s Global 7500 might be the best of the long-range aircraft, but values dropped for the first time because of pre-owned sales numbers finally starting to come in.

Dassault is gaining ground with the Falcon 6X, but it’s a niche market, with a cultlike following. Pilatus is quietly taking market share with the PC-24, even though pre-owned values continue to slide with higher-than-normal inventory, and Embraer is delivering Praetors like clockwork but the days of avoiding drops in residuals values looks to be behinds us especially for the 100 and older Legacy platforms

The Honda Jet leads the way across all negative gauges of the market, whether time to resell, the number for sale and especially runway incursions.. But here’s the problem—despite strong demand, something is bottlenecking production.

It’s been five years since the excuses started with Covid. The backlog doesn’t matter if you can’t deliver the aircraft. It’s fairly obvious that R&D has taken the back seat as the OEMs, vendors and parts suppliers are still dealing with the fallout from COVID issues and who can blame them, the dollar will only go so far and with apparent belt tightening occurring who knows what new technology we are missing out on.

Will bonus depreciation stimulate the market enough to offset the uncertainty? Probably not. Time will tell, and as businesses adjust to regulation changes, and figure out how much is a bluff vs art of the deal, the markets will settle down. Financing is challenging, and scrutiny on credit is high. We have seen a jump in both reported delinquencies and foreclosure

Market Trends: Helicopters

In the helicopter sector, market momentum remains steady, though not without caveats. Demand continues to center on utility-configured singles and medium twins, especially for EMS, offshore, and public safety roles.

Financing activity usually increases this time of year, but closing times are stretching longer than scrutiny over maintenance history deepens.

After a turbulent few years, turbine helicopter values are stabilizing, though some older legacy platforms (like the Bell 412 or early EC155s) are seeing reduced liquidity. The offshore energy sector has shown signs of recovery, particularly in West Africa and parts of Southeast Asia, which is positively affecting demand for heavier twin-engine rotorcraft.

However, continued scrutiny of operator risk and cost-per-hour performance is reshaping how leasing and financing deals are structured. The long-term outlook is cautiously optimistic, especially as new production from OEMs like Airbus and Leonardo remains limited.

The first half of 2025 has brought renewed complexity to the commercial aviation landscape. Silver Airways’ Chapter 11 filing underscores persistent challenges in the U.S. regional airline market, particularly among carriers operating smaller turboprops with thin margins and high operating costs.

Globally, airlines are still on the road to full recovery, with international traffic rebounding and load factors stabilizing, but geopolitical instability and fuel price volatility continue to pose risks. Meanwhile, OEM production remains constrained by supply chain issues, keeping new aircraft deliveries below demand. This has driven up values for mid-life narrow bodies and sparked renewed interest in older regional jets like CRJs and Embraer E145s, though 50-seat types remain challenged by pilot shortages and unfavorable economics.

On the cargo side, the airfreight market has seen a moderate rebound in yields, with demand for converted widebody freighters leveling out, particularly for 767s and A330s.

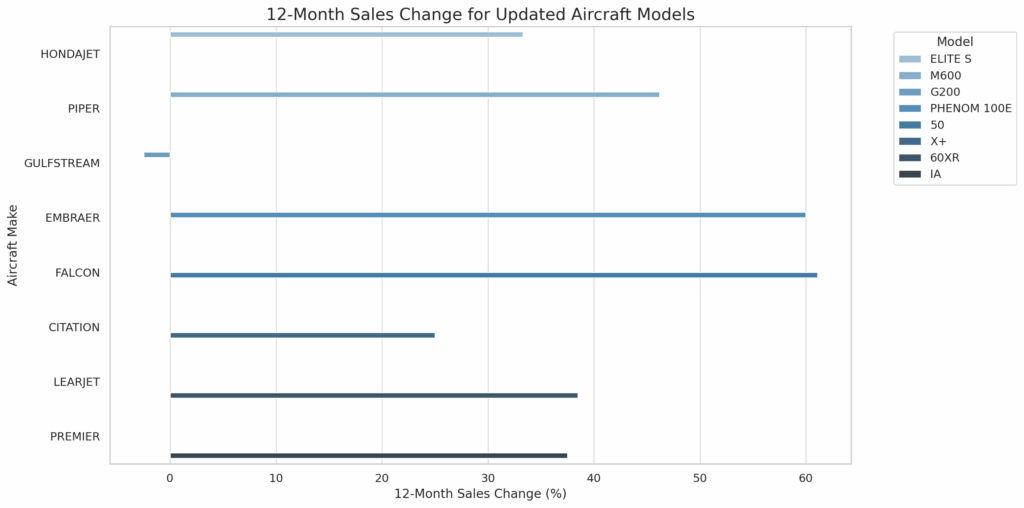

Market Trends: Business Jets

We’re also watching the used jet market swell. Over 1,150 used business jets are for sale—up 7% year over year, though slightly down from December. Inventory for newer jets (less than 7 years old) is up 12% YOY. Midsize jets are leading the inventory surge (+15%), light jets are up 9%, while heavy jets are down 3% apart from the G550 platform. Pricing is adjusting downward pretty much across the board, except for G600’s. The models with flat quarter to quarter changes in value are the bright spot, and few and far between.

Market Trends: Piston Aircraft

Piston sales, which usually heat up in spring, have been sluggish. Tariffs rattled buyers, and uncertainty around trade, taxes, and parts sourcing from overseas vendors has everyone spooked. Market value whiplash because of tariff knee-jerk reactions caused many buyers to sit on the sidelines.

Financing has gotten tighter—higher down payments, higher interest rates, stricter underwriting. If you’re trying to sell anything over $500K without cash in hand, good luck. Sellers are sitting on assets longer, and buyers are stalling, waiting for clarity.

The only bright spot remains the trainer market; In fact, this market is moving in the complete opposite direction of everything else except for the 421C and 182 markets. The lack of available G1000 172’s is just crazy. If you are the unfortunate owner of a non-Autoland SR22 G7, then I am also the bearer of bad news as values have been corrected sharply down because of the mid-year announcement, and a higher than normal G6/G7 inventory.

Last count was almost 200 were for sale between Turbo and Non-Turbo. Diamond’s DA50 also appears to be a market in correction as the premiums turned to discounts, along with a general lack of interest in the aviation community.

Market Trends: Turboprops

Turboprops are a different animal; they are all over the map. King Airs are flat, however, inventory is getting tighter and buyers will face limited options in several markets, including the 350, C90, 208’s. Other markets like the M350, Jet prop, Meridian, Malibu are all softer, and values dropped. The TBM and OC12 market remain unchanged, however, tariffs may play a role from now on.

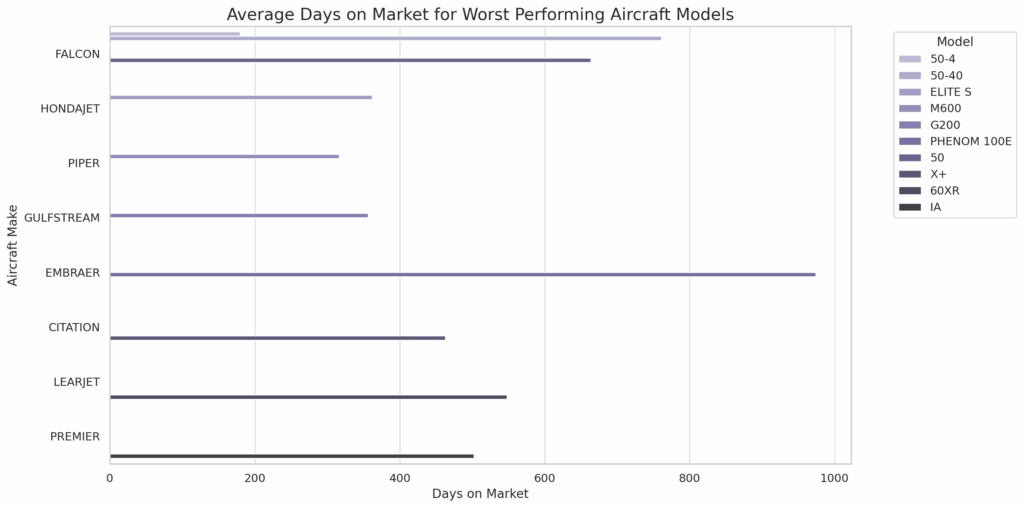

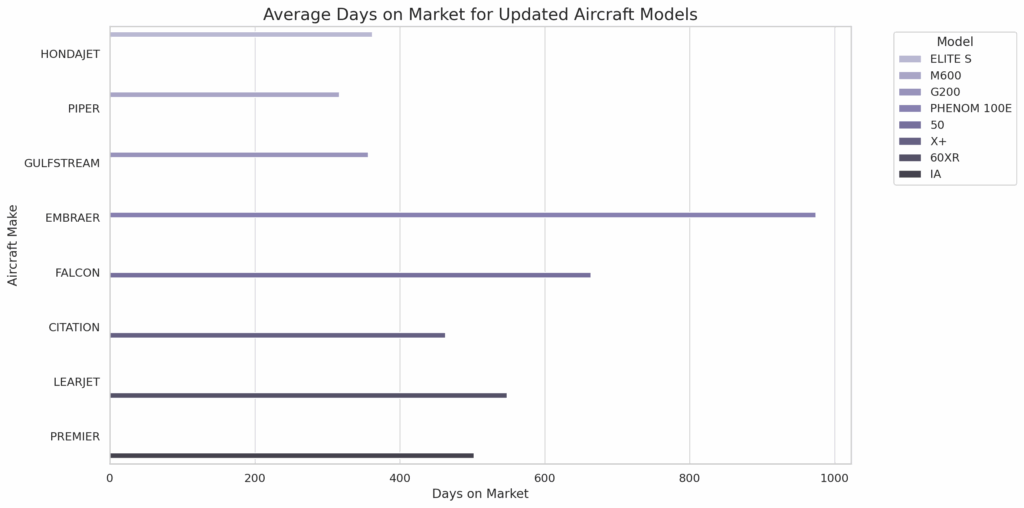

We’re tracking nearly 900 business jets and over 400 turboprops with over 180 days on the market. That’s significant. Even more significant is the lack of closings. Across all turbine sales, there have only been 3,800 closings this year, down from 4,194 for the same time frame one year ago. There have been 1,737 aircraft listed for sale since 1/1/25.

Bottom line: This isn’t a crash, but it’s not business as usual either. It’s a selectively strong market that punishes uncertainty and rewards preparedness. If you’re not ready to defend your value with clean records, current data, and sharp pricing—you’re going to be left behind.

Summary

The second quarter of 2025 has brought turbulence from nearly every direction. Between aggressive tariffs, regulatory shakeups, tightening credit markets, and persistent production delays, this has become a marketplace defined less by momentum and more by volatility. Cautious buyers and stalled sellers are causing value corrections across many categories, even in previously immune markets.

April’s economic data hit like a freight train. Non-defense aircraft orders plunged over 50%, and the broader durable goods sector showed the telltale signs of policy-induced shock. Tariffs aimed at protecting U.S. manufacturing have had the unintended consequence of paralyzing purchasing activity, disrupting supply chains, and triggering price uncertainty for OEMs, operators, and maintenance providers alike.

And as many have speculated, this might not be accidental. In a market where direct bailouts are politically toxic, these protectionist moves appear engineered to give Boeing some breathing room—without writing a check or holding a press conference.

Regulatory change added more noise. The FAA’s proposal under Docket No. FAA–2025–0638 to allow aircraft owners to withhold personal information from the registry has stirred genuine concern. While privacy is a legitimate goal, the execution matters. Without a structured tiered-access model for vetted professionals—escrow officers, lenders, brokers, and service providers—we risk crippling the very transparency that makes aviation transactions viable. The industry doesn’t just need data—it depends on it.

And yet, the market is not collapsing. In fact, it’s functioning precisely as it should during a stress test. Pricing is adjusting. Margins are being recalibrated. The flood of cheap capital is over, and we’re back to fundamentals.

There’s a quote from one of the greatest films ever made, Wall Street (1987) that feels especially relevant right now. In one of the film’s lesser-quoted but most powerful exchanges, veteran trader Lou Mannheim tells Bud Fox, “Anybody can make money in a bull market—the real test is what you do when it goes down.” It’s not just a line—it’s a lesson. That film, and that era, were about excess and timing. But the wisdom underneath holds up. When the tailwinds disappear, you find out who really knows how to fly.

We’re in one of those moments. Bloated inventory in some segments, selective buyers, and difficult financing characterize this moment. But with that comes opportunity.

For sellers: clean up your records, get real about pricing, and work with professionals who understand how to navigate turbulence.

For buyers: this may be the best pricing environment you’ll see for the next 18 months—especially if you’re looking for mid-life jets, older turboprops, or distressed piston inventory. And for lenders, now is the time to partner with trusted valuation sources and stay ahead of trend-line risk.

Fall 2025 could shape up to be a pivotal quarter. If bonus depreciation sticks around and political headwinds calm, we could see a rush of late-year activity. Smart players are already positioning themselves—quietly, carefully.

This isn’t a crash. It’s a test of character. The market’s still moving. The question is: are you ready to move with it?